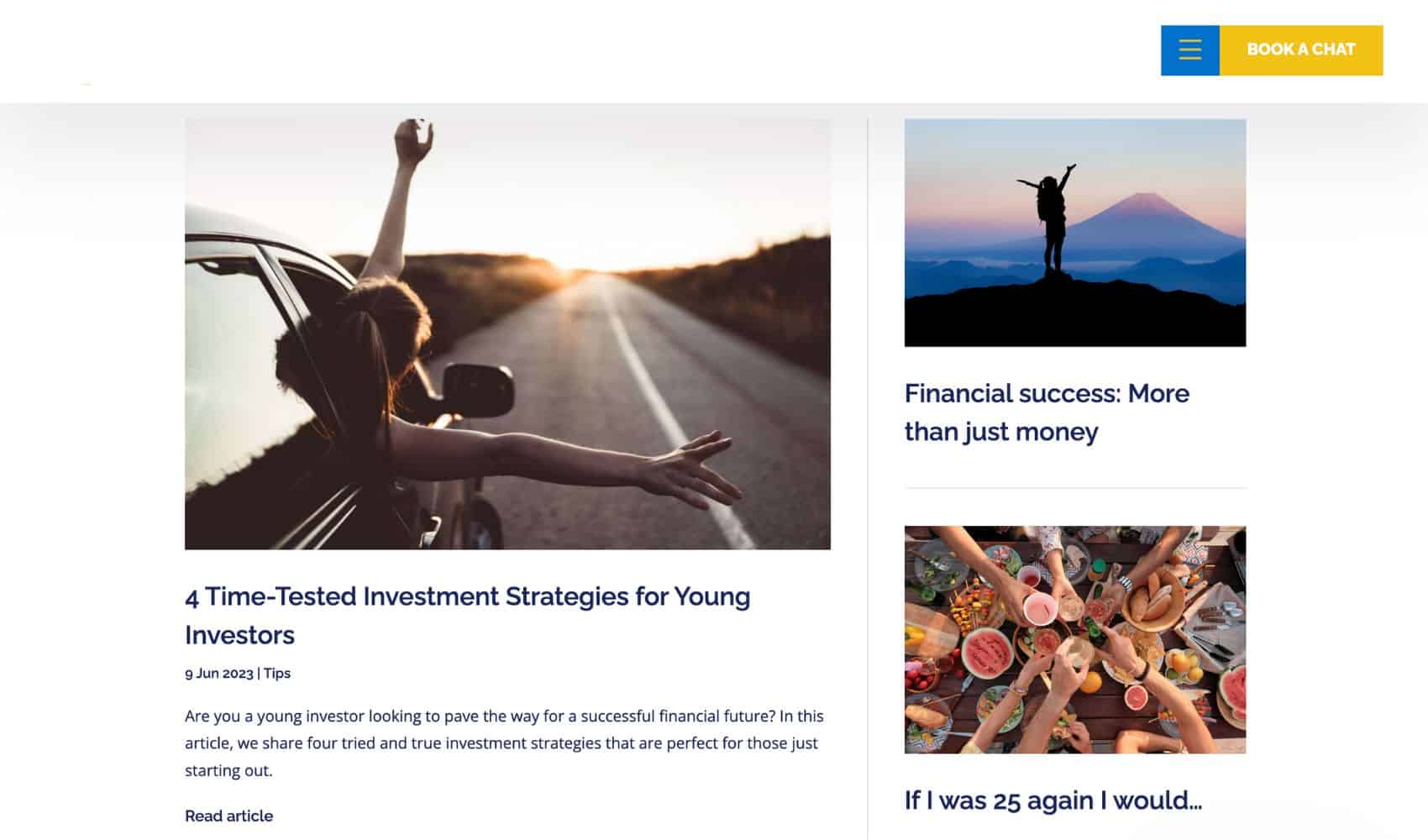

In today’s fast-paced digital world, having a static, unchanging website just doesn’t cut it. You know this already, right? You have a website, but does it pulsate with life, engage visitors, reflect your brand identity, and share your story in a compelling manner? Or is it merely a digital calling card that offers little more than your contact details and a rundown of your services?

An out-of-date website does the opposite of what it was intended to do. Instead of building credibility, it destroys credibility.

An engaging and updated website is particularly important for financial advisers. As you know, trust is paramount in the world of financial advice, and your website plays a vital role in building that trust. It may come as no surprise that the design of a website can significantly impact customers’ trust and their subsequent behaviour, underlining the profound influence your website has on potential client’s perception of your brand (Guo et al., 2023).

Current clients may be hesitant to refer you to others if your website is outdated or looks amateurish. They might fear it reflects poorly on them if they recommend a financial adviser whose website doesn’t look up-to-date or professional. After all, who would want to entrust their hard-earned money to an adviser whose online presence seems neglected?

Moreover, a clearly outdated website can actively drive potential clients away. Imagine landing on a blog page whose most recent articles are date-stamped from 2022. It instantly gives the impression of a dormant, disinterested, or overwhelmed business, which can be a red flag for many prospective clients. In a sector where the most current advice can make a world of difference, an outdated website can signal that your practice may be struggling to keep up.

So, what can be done?

The solution lies in making a choice and sticking to it.

- Writing content: Content is key. Regularly updating your website with fresh, relevant content shows your engagement with the financial industry and makes your site feel alive and valuable. However, remember that content creation is a commitment. Before diving headfirst into a blog, we recommend creating at least four pieces in advance. This will ensure a consistent flow of content and help you maintain your posting schedule. It also gives you the chance to have your content reviewed by compliance before investing further.

- Sharing the load: Enlisting team members to share the responsibility of content creation can make the task less daunting. Regular contributions from different team members not only diversifies the content but also ensures that each piece is written by a subject matter expert. This approach can enhance the quality of your content and keep everyone engaged.

- Outsourcing content: If creating your own content isn’t feasible, consider hiring a third party to help with either shadow-written or off-the-shelf content. There are numerous agencies that specialise in providing high-quality content for the financial sector. We work closely with one such company, Financial Writers, so please reach out if you’d like to learn more about how they help keep your content up-to-date whilst saving you time.

- Less is more: If you decide not to commit to content creation, it’s essential to avoid dating your site. A website that appears neglected does more harm than good. A site with a simple, current design is always a safer bet than one that clearly shows its age.

The importance of regular website updates

Maintaining and updating your website is crucial for more than just aesthetics. It provides valuable, current content for your existing and prospective clients, demonstrates your ongoing engagement with the financial industry, and ensures that your business appears active and invested in client service. Moreover, a well-maintained site improves your SEO, as Google rewards sites with regular updates.

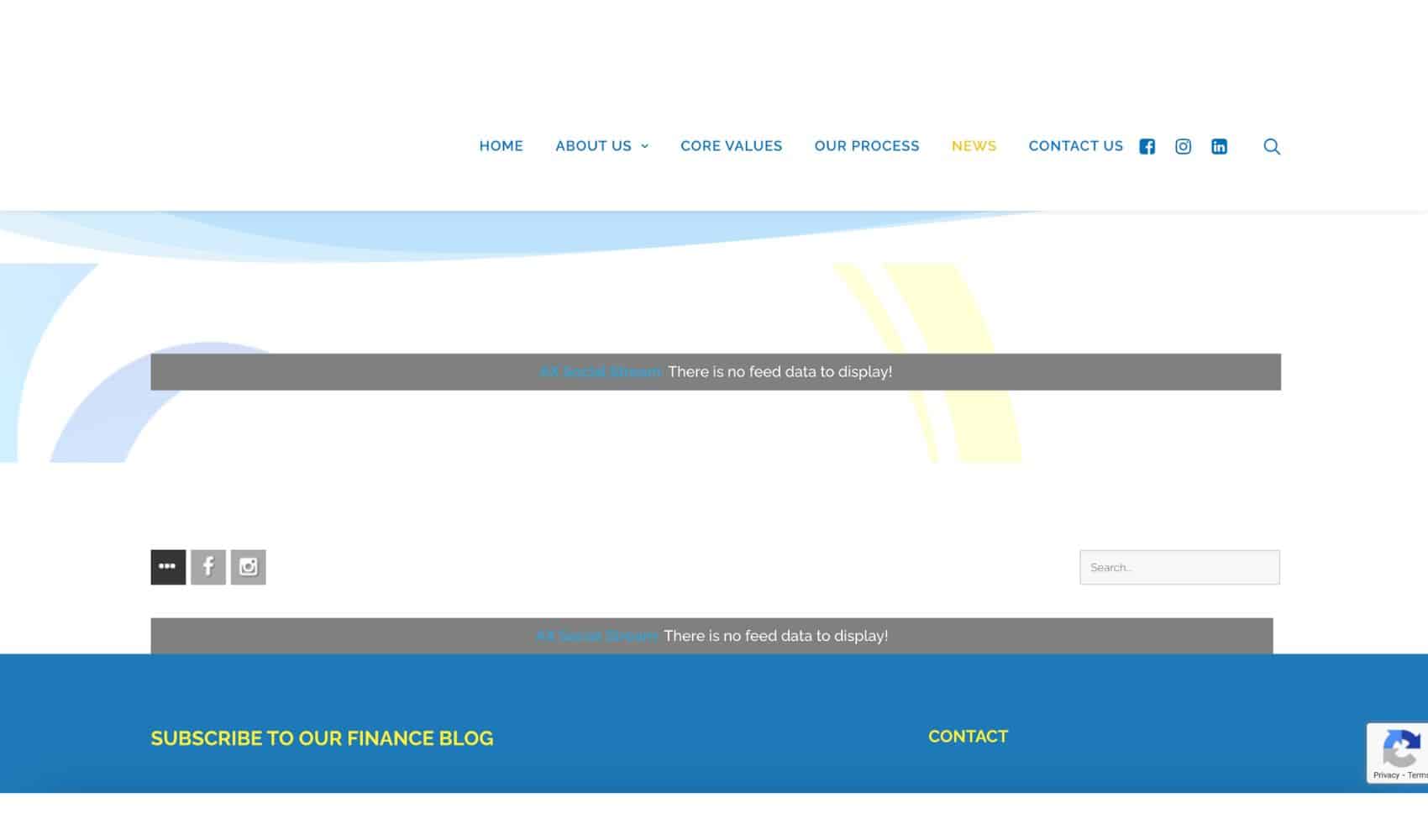

Case study

Let’s take a look at a recent case to illustrate this. We collaborated with our client to redesign their website, which included a modern design, updated copy, and a new blog platform. As you can see in the ‘before’ photo below, their blog feed was completely broken, representing a substantial missed opportunity for engaging prospective clients. What’s more, their home page featured blog posts that were several years old, giving the impression that the firm was not active.

By utilising our services, our client transformed their digital presence, enhanced client trust, and dramatically increased the likelihood of collecting subscribers to their blog. We not only set up a fully functioning blog page but also partnered with Financial Writers to ensure that fresh, relevant content is published on their site on a weekly basis. With this system in place, our client can focus on what they do best; providing excellent financial advice to their clients.

Just imagine what a revamp could do for your website! Reflect on your current online presence and consider how it could be improved. Remember, a well-maintained and regularly updated website can be a powerful tool for engaging prospective clients and establishing your firm’s expertise in the field.

Need a tailored website solution? We’re here to help

If you’re a financial adviser looking for a website that truly represents your brand and engages your visitors, look no further. Our website service at Simply Advice Websites specialises in designing tailor-made websites that meet the unique needs of financial advisers. Our suite of design options ensures you have a website that not only looks good but feels alive too.

Don’t just have a website, breathe life into it. Book a complimentary chat with our experts here.